As a rule, political economists of the present day do not take the trouble to study the history of money; it is much easier to imagine it and deduce the principles of this imaginary knowledge Alaxander del Mar, A History of monetary systems (1901)

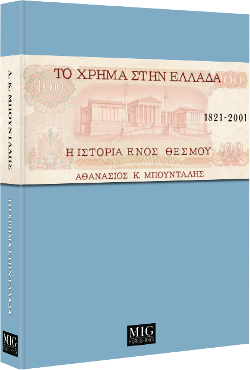

"Money in Greece", the book

The historical study of the institution of money in modern Greece is particularly fragmentary; while there are numerous studies of a very high level of historical research, these delve into specific themes: they study specific periods or geographical areas, they deal with the history of a particular credit institution, or they cover exclusively the physical form of money (paper notes, coins). Studies spanning larger historical periods mainly address the general economic history, treating money as something neutral. Thus, there is no study in the modern literature covering the history of money as a legal and state institution throughout modern Greek history, from the Revolution of 1821 to the EMU (the sole such exception is of limited scope, while the presentation of statistical data is limited, precluding its use as a reference work by interested researchers).

The present study examines money in Greece from 1821 to 2001, not as a physical object or a commodity, but as a state and legal institution. It carries out an in-depth analysis of critical monetary events and decisions of modern Greek history, mainly drawing upon primary sources (yearly reports, statutes and other archival material of Greek banks, minutes of parliamentary procedures, correspondence, Government Gazette issues, newspaper articles, etc), secondary works and presenting extensive statistical material. It attempts an explicit and in-depth comparison of the selected theoretical framework with the historical empirical evidence, drawing to specific conclusions regarding the ontological understanding of money in modern Greece.

2nd Edition (2016): 618 pages, 103 tables, 8.5 x 11 x 1.39 in / 21.59 x 27.94 x 3.53 cm

ISBN: 978-9609377584

Contents (download pdf)

1.1. The modern economic thought about money and the legacy of Adam Smith

1.2. The credit theory of money

1.3. The anthropological interpretation of barter

1.4. The state theory of money

1.5. Issues of monetry theory relevant to this book

1.6. The political significance of the choice of a hermeneutic framework

1.7. The choice of a hermeneutic framework

2.1. The monetary chaos

2.2. The revolution's currency

2.3. Revolution finances and the first paper note

2.4. The loans of Independence

3.1. The Greek State (Ελληνική Πολιτεία)

3.2. The candidate King Leopold and the attempt for a 60 million franc loan

3.3. The establishment of the National Finance Bank

3.4. Internal loan and the second Greek paper note

3.5. The introduction of the Phoenix

3.6. Issuance interest-free paper money

3.7. A brief assessment of Capodistria's monetary legacy

4.1. The institution of the new monetary system

4.2. The failed consolidation of the drachma in its physical form

4.3. The dissolution of the NFB and haggling over a new note-issuing bank

4.4. Borrowing

4.5. Some conclusions on the new monetary system

5.1. The Ionian islands

5.2. The existing monetary status quo

5.3. High Commissioner Nugent and thoughts of the establishment of a state bank

5.4. Haggling over a private bank

5.5. Announcement and start of operations

5.6. Monetary circulation and the legal foundation of money

5.7. Conclusions

6.1. The establishment

6.2. The symbiotic relation money lenders

6.3. The first crises of the NBG and salvation by the state

6.4. Privilege renewal - NBG's renewal

7.1. The choice of the new King is made by a banker

7.2. The Ionian islands and the Ionian Bank

7.3. The "Latin" Monetary Union

7.4. Greece's participation in the LMU

7.5. The Cretan Revolution and the third cours forcé (1868)

7.6. Minting the new drachmas

7.7. The fourth cours forcé (1877)

7.8. Some conclusions

8.1. The expatriates' bank

8.2. Our guy

8.3. First attempt: the "General Credit Bank"

8.4. Second attempt: the "Privileged Bank of Epirothessaly" S.A.

8.5. The monetary war between NBG, Ionian and PBE

9.1. External overborrowing

9.2. Activation of the LMU treaty

9.3. Lifting of the cours forcé

9.4. The new cours forcé of 1885

9.5. Towards bankruptcy

9.6. After the bankruptcy

9.7. The war of 1897 and its consequences

10.1. The borrowing

10.2. Exchangce rate of the drachma until 1910

10.3. Toward the lifting of the cours forcé... again: the new monetary system

11.1. War and monetary institutions

11.2. Circulation in time of war

11.3. The question of foreign exchange

11.4. The protection of foreign exchange

11.5. Need, the mother of invention: forced loan of 1922

12.1. Dealing with dire straits

12.2. The stabilisation loan and the battle for the issuing privilege

12.3. The Geneva protocol

12.4. The establishemnt of the "Bank of Greece" S.A.

12.5. The issue of the metallic cover and Venizelos' political come-back

12.6. The other points of friction and their resolution

12.7. The new drachma

12.8. The League of Nations and Central Banks

13.1. The "battle of the drahma"

13.2. Central banking in Greece: from theory to practice

13.3. The drachma after the "battle" and before the war

13.4. Recovery

14.1. Monetary institutions on the eve of war

14.2. The flight of the government, of the BoG and of the gold

14.3. The conquerors' paper notes

14.4. A handbook to plunder, part I: "accounting plunder"

14.5. A handbook to plunder, part II: "monetary plunder" or "occupation loan"

14.6. The failed "measures"

14.7. Mountain government: currency or not?

15.1. Pre-liberation discussions and Varvaressos-Zolotas undert-the-table rivalries

15.2. Liberation and transitional measures

15.3. Svolos-Zolotas monetary stabilisation on Waley's plans

15.4. The Varvaressos experiment

15.5. The Tsouderos-Bevin deal

15.6. The rate of pre-war drachmas for joint-stock companies

15.7. American aid, american control

15.8. Monetary control under the AMAG

15.9. Some conclusions from attempts at monetary stabilisation

16.1. The new international context: the Bretton Woods system

16.2. The Varvaressos Report "on the economic problem of Greece"

16.3. The Markezonis devaluation

16.4. The day after

16.5. Money and banking in a centrally planned capitalist economy

16.6. Conclusions about the value of the drachma

17.1. A brief history of the EEC

17.2. The unstable dollar and the European common currency

17.3. Nixon's shock: tunnels, snakes and lakes

17.4. Toward monetary integration

17.5. The European Unit of Account

17.6. The European Monetary System and the ECU

18.1. A comment on the use of GDP

18.2. The Greek economy in transition

18.3. The floating drachma

18.4. Inflation: monetary expansion and external shocks

18.5. Institutional changes in money creation

18.6. Drachma's participation in the ECU

18.7. Conclusions

19.1. EMU's political background

19.2. EMU and businesses

19.3. The Delors Committee Report

19.4. ERM's (dys)function

19.5. The Maastricht Treaty

19.6. Convergence criteria: the new fetish

19.7. Not even the Germans fight against necessity

19.8. Euro in the home stretch

19.9. Theoretical approaches against a monetary union

20.1. The ideological bachground of a Greek participation in the EMU

20.2. The post-dictatorship regime in crisis

20.3. Monetary and exchange-rate policy of a new era/p>

20.4. Successive governments looking toward the EMU

20.5. EMU and the "hard drachma"

20.6. Speculative attacks

20.7. Drachma's devaluation and entry into the ERM

20.8. EMU and the stock-exchange bubble

20.9. Euro kick-off. The drachma in ERM II

20.10. Greece is accepted into the euro

20.11. Cooking the books of Greek debt

21.1. Preliminary discussions

21.2. Discussing the Maastricht Treaty in the Parliament

21.3. After Maastricht

21.4. The euro and Greek businesses

21.5. The final run: views about entering the euro

21.6. Discreet criticism

21.7. The case of the Communist Party of Greece (KKE)

21.8. The heretics

21.9. Some comments on the expressed views

22.1. Χαμηλά επιτόκια και υπερδανεισμός

22.2. Η Ευρωπαϊκή Κεντρική Τράπεζα

22.3. Το Ευρώ σε φυσική μορφή

22.4. Αύξηση τιμών

22.5. Γερμανία, εξαγωγικός κολοσσός

22.6. Η πρώτη δεκαετία του ευρώ: προοπτικές

22.7. Οι δύο δρόμοι

23.1. Η κρατική ισχύς και το χρήμα

23.2. Κρατική νομισματική θεωρία και πράξη

23.3. Ξένος έλεγχος του νομισματικού συστήματος

23.4. Τελικά συμπεράσματα

24.1. Ο κρατικός σε σχέση με τον «ανεξάρτητο» χαρακτήρα των ελληνικών Εκδοτικών Τραπεζών

24.2. Εκτιμήσεις της ποσότητας χρήματος, 1836-1999

24.3. Η «μεταλλική δραχμή»

24.4. Το χρήμα στα ελληνικά Συντάγματα

24.5. Τοπικά νομίσματα

24.6. Λογιστικές τεχνικές που επέτρεψαν την εισδοχή της Ελλάδας στην ΟΝΕ

24.7. Η κρίση του ΜΣΙ του 1992-93

24.8. Βασικά μακροοικονομικά και δημοσιονομικά μεγέθη, 1960-2011

25.1. Επίσημες και ανεπίσημες ισοτιμίες των εθνικών νομισμάτων

25.2. Κοπές μεταλλικών νομισμάτων

25.3. Αρχικές διανομές μετοχών ελληνικών εκδοτικών τραπεζών

25.4. Ποσοτικά στοιχεία κυκλοφορίας χρήματος, 1836-1999

25.5. Νομισματική πολιτική 1974-2000

25.6. Πληθωρισμός

25.7. Συνοπτικά στοιχεία ελληνικών δανείων

25.8. Δημοσιονομικά στοιχεία 1960-2012

25.9. Απολήψεις κοινοτικών κονδυλίων

25.10. ΟΝΕ, Ευρώ και ΕΚΤ