No example of a barter economy, pure and simple, has ever been described, let alone the emergence from it of money; all available ethnography suggests that there never has been such a thing Caroline Humphrey, Barter and Economic Disintegration (1985)

The euro: opportunity for the German industry. Report of the EMU Industry Forum (1996)

[This report was published in 1996 by the Federation of German Industries (BDI) in German. The original is republished here under permission from the BDI and the following is an unofficial English translation.

Note: This translation is mostly machine-generated. Although it has been carefully checked, some parts might not be perfectly precise. I welcome any correction from German speakers.]

Contents

1. Improving the status of information and creating acceptance

2. What does the Monetary Union bring to the industry?

1. Europe needs the monetary union

2. German industry is benefiting from Europe

III. Opportunities and risks of monetary union from the perspective of German industry

1. Euro ensures fair competition of performance

2. Small monetary union as a core

3. Impetus for the internal market

4. Dynamic Europe through stability

5. Beneficial constraints on economic, fiscal and wage policy

IV Currency conversion: What lies ahead for businesses?

1. When and how the conversion?

2. The market punishes latecomers

3. Euro checklist for key business sectors

4. Cost of currency conversion: Investing in the Future

V. Conclusion: The euro has come

1. Opportunities outweigh risks

Foreword

For several years the economy in Europe grows slower than in America and Asia. This is reflected not only in the shrinking market share of our exports, but also in the labor market. While during the last 25 years the USA could create more than 40 million and Japan just 14 million workplaces, the countries of the European Union, in spite of higher total number of inhabitants, created just about 7 million jobs in the same period.

The competition between regions takes place according to rules similar between companies: If the competitions is constantly improving, but you hardly change yourself, you will fall behind. Germany has fallen behind compared to other competitors. Government, business and social partners are in the process of making the necessary changes so that we can again create the connection to our own needs and quickly respond to other economies. Not only Germany, but the "old continent" as a whole, needs new strategies to catch up again with North America and East Asia. Politics have made two important strategic decisions: EU enlargement and monetary union.

The European Monetary Union is a particularly important contribution to make us competitive again. The joint efforts towards Maastricht are now beginning to pay off: The convergence pressure prior to monetary union exerts a positive influence on stability and public finances in Germany and our European partner countries.

Empirical comparisons show an impressive correlation between success in consolidating public finances, the return of the state sector and the ability to create new jobs. Therefore, the convergence pressure linked inseparably with the monetary union, as well as the positive effects on the economy emanating from the single currency hold an especially important strategical position. It will help us catch up in the global competition for growth, prosperity and jobs.

The European Monetary Union and, in particular, the way there, will bring economic benefits and new opportunities. But sacrifices have to be made and there are also disadvantages and risks. For this reason, Dr. Bierich and I have convened the "EMU Industry Forum" with the goal of a sober inventory of positive and negative aspects. The result of the work of the Forum are set out below. Unanimously, the group came to the conclusion: the benefits of the monetary union prevail. And whoever wants to eliminate all risks, destroys all opportunities.

On behalf of Dr. Bierich, I want to thank everyone involved for their dedicated work.

Hans-Olaf Henkel

President of the Federation of German Industries

Cologne, in the summer of 1996

I. Objectives of the report

Europe is facing a critical juncture. The EU states are converging into a single internal market. The introduction of a single European currency aims to safeguard the achievements and promote economic integration.

The global trend towards economic globalization is forcing Germany and Europe to open up to more intense competition. The project of Monetary Union reduces nation-state mentality and promotes competition in Europe between companies, states and regions. The German economy does not need to shy away from this competition. Past experience speaks for a continuation of the open markets policy.

1. Improving the status of information and creating acceptance

The public discussion on monetary union is intensifying as the targeted starting date of 1/1/1999 approaches. The pressure of expectation is high. Approval and confidence on one hand, skepticism and fears on the other, but also ignorance and prejudice, characterise the discussion.

The lack of acceptance is above all due to insufficient information. As surveys in all European countries show, acceptance also rises with increasing information about the opportunities and risks of the monetary union.

To clarify the consequences of the single currency for the German industry, the BDI has called an "EMU industry forum". This report presents the result of the discussion.

It's not a matter of discussing from the ground up the "if" of a monetary union. This was a political decision and is answered with the ratification of the Maastricht Treaty. It should also not be speculated which Member States fulfill the convergence criteria and will ultimately participate in monetary union.

Rather, based on the following premises:

• The monetary union starts on 1 January 1999.

• It will first start with a smaller group of participants.

• Long-term stability is ensured by appropriate contractual fulfillment of the convergence criteria and an adequate institutional framework. It is important to distinguish between stability and fiscal criteria. The latter are primarily the decrease of total government expenditures and their ratio to GDP

• The governments of the participating states commit themselves to a rule-based fiscal policy as part of a Stability Pact.

• The relationship between participants and non-participants in the Monetary Union will be designed so that no competitive devaluation of European currencies is possible.

2. What does the Monetary Union bring to the industry?

Under these premises the report demonstrates which economic opportunities open up by the introduction of the euro. Indeed, risks are also connected to the monetary union. Since not all uncertainties can be overcome from the outset.

In particular, problems arise when those responsible for the economic, financial and

tariff policy take no regard for the economic consequences of their actions.

But the philosophy of the Maastricht Treaty is clear. The primary objective of the common monetary policy is to ensure monetary stability.

The choice of the participating nations occurs on the basis of the contractual convergence criteria. On this occasion, it should be taken into consideration that the Maastricht Treaty has a certain discretion.

In this report, the "EMU Industry Forum" comes to the conclusion that the balance of risks and opportunities is positive and that it pays to stand up for monetary union and the euro. Furthermore the report indicates what is coming to companies, and gives the first tips on how they can cope with the changeover.

Convergence criteria for EMU entry ticket

• The inflation rate should be at most half a percentage point above the average of the three best-performing EU countries.

• The nominal long-term interest rate shall be not more than two percentage points above the average rate of the three best-performing countries.

• The currency must have moved at least two years without major tensions within the normal fluctuation margins of the ERM exchange rate and must not have been devalued during this time.

• The public budget deficit must not exceed the reference value of 3% of gross domestic product, unless

-either the ratio has declined substantially and continuously and reached a level close to the reference value

-or the excess from the reference value is only exceptional and temporary and the ratio remains close to the reference value

• The total public debt must not exceed the reference value of 60% of the gross domestic product, unless the ratio is sufficiently diminishing and approaching quickly enough the reference value.

II. Why the monetary union?

The main purpose of the monetary union is to improve efficiency and competitiveness of the European Union. Monetary union, however, as part of overall European integration process, has importance well beyond economic interests. If succesfull, it could become to some extent a lever for political unification of Europe.

1. Europe needs the monetary union

The need for coordinated and unified action in Europe is increasing. The new economic and political challenges in Europe and worldwide which the next decade will bring us can no longer be mastered within Europe's status quo.

A closer collaboration in the EU's foreign policy is also of great importance for the stabilization of the situation in Central and Eastern Europe. The entry of these countries in the community is the next big integration target and is on the next years' agenda. The associated increase in the European Economic Area will increase the economic benefits of the large market and further increase the political weight of Europe.

The extension of today's 15 to twice as many members one day requires timely reforms on the part of the EU. Not only the institutions and decision-making structures, including the agricultural and structural policy, but the financial condition must be adapted to the new situation. These reforms have top priority. However, they also require a high degree of shared decision-making ability and determination by the Member States.

The ability of the EU, scheduled to enter into a stable monetary union, will decide whether and how quickly it will come to these necessary evolutions internally and externally.

The changed economic and political coordinates underline the urgent need for further economic and monetary integration in Europe. Germany and its European neighbors have to participate in an increasingly fierce competition with other major economic regions. The closer the economies come together, the faster and more intensely globalization progresses, all the more different national economic conditions play a role.

The extensive interdependence between the Western industrialized countries and the strong growth of international capital flows, render virtually impossible a solution of economic problems on a national basis.

This does not mean that all areas of economic policy require a centralized solution. Rather, the Principle of subsidiarity, to decide which policy can be controlled at each European and national Level.

Despite that, some of our problems are of global nature and can no longer be managed in a German single-handed effort. With nearly 20 million people - roughly equivalent to the entire population of Denmark, Portugal, Ireland and Luxembourg - unemployment in Europe has not reached a more acceptable level. Even Germany can not afford more than 4 million unemployed in the long run.

This is not a carte blanche for new community responsibilities. For the undisputedly most important task, the reduction of unemployment, the move into political action must be resolved by governments and social partners in Member States. The best policy is still stable and improved economic conditions, with more free space for the economy. For this, the single currency will contribute significantly, so that the monetary union proves to be another growth-stimulating element.

2. German industry is benefiting from Europe

The tight integration of Germany into the EU is in the best interests of German industry. In the mean time, Europe has become for enterprises the "home market" with 370 million people. The free movement of goods, services, capital and people in a space that will soon include the whole of Europe means a location potential, which previously was only available to the U.S. economy.

Besides, European interests – and German with them – can only be efficiently represented in the international context if the European Union finds a common point of view in the essential questions and appears united from the outside. In the end, we owe the restoration of German unity to European integration.

At the heart of the European integration process, the common market has brought Germany an unprecedented period of economic stability and economic progress. The merging of the goods, services and financial markets has made a positive effect on German industry.

About a quarter of our economic output is generated through exports, 60% of which in trade with our EU neighbors. Half the jobs in the industry depend - directly or indirectly - on exports.

So that monetary policy in 21st century Europe and worldwide proceeds more smoothly than the current turbulent 20th century, the European Monetary Union and its success is essential. The time remaining until the scheduled start of monetary union, as measured by the tasks yet to be done, is short. But it is enough to create the conditions necessary for its operation. All experience shows that plans not get stuck only when the corresponding pressure is applied in their implementation.

III. Opportunities and risks of monetary union from the perspective of German industry

1. Euro ensures fair competition of performance

For 30 years there are no more duties in the European Union, the last 3 years the hidden trade barriers have been almost completely removed. One speaks proudly of the European Single Market. Nevertheless, Europe is still far from being an economic unit. For within the European Union there are now next to the D-Mark 13 other currencies. How the exchange rates of some of these currencies against the deutschmark develop is unpredictable. Months of silence on the currency markets can be cast aside by sudden severe turbulence. The latest example is the chaotic weeks in the spring of 1995 when the European exchange rate structure was shaken.

... D-Mark exchange rate always increasing

The currency turmoil of recent years always ended with a higher exchange rate of the D-Mark. To the extent that such costs rise more slowly than prices in Germany and abroad, a DM-revaluation is bearable for German enterprises. Such revaluations are not detrimental for international competition. But the practice is different.

The exchange rate was not competitively neutral. The international foreign exchange markets have their own laws. They have become partially decoupled from the development of the real economies of individual states. Apart from the calculable changes in fundamentals, political expectations or speculation also cause strong price fluctuations.

Thus, the D-Mark came out excessively appreciated in the spring of 1995 - not only compared to the dollar, but also compared with the lira, pound stirling, Swedish krona and peseta. Many German companies had to lower their prices despite rising costs to continue to remain in the markets. They had to position themselves against competitors from Italy, Spain and Britain, who suddenly had 10 to 20% more space than before in costing.

The Annual reports of the German industry enterprises speak for themselves. They give an idea of the dimension of lost sales due to exchange rates and suffered loss of earnings. This affects not only large companies. For medium-sized companies the case is similar, if not worse, in terms of the respective added value.

The fact that the German economy is burdened with the world's highest labor costs is an essential part of the unbroken dynamics of non-wage costs. However, the dramatic appreciation of the DM in recent years has worsened our position relative to our foreign competitors.

According to calculations, about one-third of the rise in unit labor costs since 1989 is "homemade", as opposed to two-thirds which are a result of monetary shocks. Such a situation should not be repeated. In this framework, social partners and government recognize that the distribution margin has narrowed.

...Location suffers from shock-like revaluations

In the beginning of the 90s the German industry had invested gigantic sums of money, and a lot of thought, even in high-cost location in Germany and successfully competed in world markets. At first the effort was absolutely worthwhile: The foreign orders for German industry have strongly increased in 1993/94. Nevertheless, in the spring of 1995 a large part of its success, was threatened almost overnight by the DM revaluation. The orders from abroad plunged, although the first rays of hope now show again.

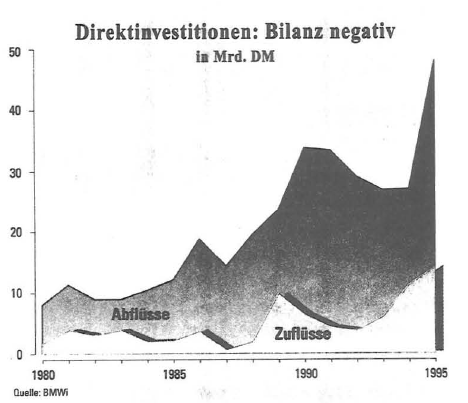

More and more companies will now have no other choice than to move some production to foreign locations. The balance of direct investment speaks for itself: German companies have invested about 193 billion abroad since 1990. Foreign companies have in turn invested only about 33 billion DM in Germany.

... Too expensive D-Mark is driving jobs abroad

The lion's share of German direct investment still goes to the EU area, apart from France, especially to Great Britain, Italy and Spain, i.e. countries with considerable depreciation rates against the D-Mark. A portion of the foreign investment is due to the high-flying DM.

The jobs "export" associated with relocation of production is significant. It is feared that in large part these jobs are lost for good. The euro would help us to reduce workplace risks in the future, as far as they have their origin in a currency-related deterioration of location conditions and are not based on the real economy.

This example shows that Europe still has a long way to go, as long as the monetary issue is open. The abolition of tariffs and the opening of markets should provide all companies the opportunity to show what they can do in a unified and orderly market. The efficient ones should be rewarded!

... Small- and medium-size companies benefit

Small- and medium-size industry companies would benefit from the fact that Europe is gradually freed from unpredictable currency fluctuations. Indeed, they usually have a lower share of exports than large firms. But as suppliers to bigger ones they have to rely on those that successfully operate in exports.

As a result of the relocation the new supplier networks are inevitably linked - often to the detriment of small and medium-sized partners in Germany. The network of industrial supplies in Germany is not nearly as robust as before. Under the pressure of competition, more and more companies are forced to divert to foreign suppliers instead of their regular German ones.

Due to the appreciation of the D-Mark not only has the price competitiveness of German companies abroad suffered, but the import competition has significantly intensified. This is especially true for branches with middle-sized structures.

The currency-related cheapening of foreign products in Germany is forcing domestic suppliers to reduce their prices, leading to the deterioration of their financial position and loss of market share domestically. Greater exchange-rate stability would reduce import competition and, since there is no need for currency hedging wold also lead to a relief on the import side.

... Currency fluctuations cost billions

Unpredictable currency fluctuations cost the German industry billions in transaction and hedging costs. Considerable costs are incurred by companies especially with longer periods between placing of orders and payment. In some cases a large portion of the - already not generous - yield margin is eroded.

In a monetary union transaction and hedging costs have no place. The European Committee estimates the potential cost reduction at about 40 billion DM annually over the whole EU. These savings are, however, under the condition that all 15 Member States are in the process from the beginning.

Also, the currency risk and its negative consequences cannot be avoided by invoicing in Deutschmark. In particular, customers from European soft-currency countries demand substantial price concessions in return for invoicing in Deutschmark.

For German companies, the cost savings with this respect happens at another level. DM invoicing must only be "earned" in the market. In any case, the extent of cost savings depends on the foreign trade structure of the enterprises as well as how many and which countries participate in the monetary union.

Indeed, transaction and currency-hedging costs hit comparatively harder in the middle range. But for many SMEs currency hedging does not take place at all due to cost considerations. The transition to the euro creates benefits for the middle class in other ways, notably through the elimination of lost revenues and market-share losses.

In comparison to larger companies, middle-range ones generally lack the possibility of intra-group balance of incoming and outgoing streams. This also makes them inherently vulnerable to currency changes. This disadvantage is continuing in the future.

2. Small monetary union as a core

... With a small euro-group already a lot would be gained

It is impossible that all 14 European currencies can be replaced by the euro by the end of the decade. Since the euro may not become an inflated currency- it should rather be as stable as the D-Mark. Hardly any of the EU countries, not even Germany, currently meet the stringent requirements for entry into the monetary union.

Even in the case that only a small group of countries start the euro, already a lot would be gained for the German industry. The burden of the reserve currency role of the D-mark would be distributed across several shoulders in the common finance market. This would help to better cushion the adverse effects of massive capital inflows and outflows on the common currency exchange rate, the EU economy, as well as on the interest rate and inflation.

There should be, however, a "critical mass" of participating countries. Without Germany and France the monetary union does not make sense.

If at the beginning only a small group of countries enter the monetary union, this means no splitting of Europe. The Maastricht Treaty explicitly provides for a tiered approach. Monetary union is not a single step, but a process. The interest in the monetary union is very large in all EU countries. This is seen in the tremendous, and from a domestic standpoint difficult, stability and convergence efforts undertaken.

The perspective of joining the monetary union, is greatly favored. Sooner or later the currency union will have a suction effect and integrate most of the remaining countries not yet under the monetary roof.

... Stable exchange rates to non-participants

In the case of a partial monetary union, devaluation of non-accession countries to the EU core cannot be ruled out. A competitive devaluation is no reason to fear nonetheless.

Economic policy has long since learned that the estimated economic costs of a devaluation are higher than the attainable short-term competitive advantage.

The currencies of latecomers are chained to the euro. A modified European Monetary System - "EMS II" - that allows less stringent regulations depending on the participating country creates good opportunities. This will also help European countries not to divide.

However, the right lessons should be drawn from the ERM turmoil in recent years. The main burden of adjustment and responsibility for the exchange rate stability would have to be borne by the respective countries themselves. The stability of the euro must not be compromised by a misunderstanding of European solidarity!

Even in a small monetary union, the weight of the euro compared to the D-Mark would roughly double. Thanks to its larger mass, the euro would be firmly fixed in place. If a flight from the dollar becomes fashionable once again, then the appreciation of the euro would not be as strong as currently that of the D-Mark. The disadvantage of the German industry against competition from the dollar area will therefore not be as great as today.

... All depends on the introductory exchange rate

An important point of view of German industry is the exchange rate determination. The currency conversion shall in no case lead to new distortions in competition. As before, the D-Mark, is still overrated in terms of fundamentals.

It is important that the D-Mark goes in the euro with a competitively neutral rate. After entering the monetary union competitive distortions could only be offset by a tedious improvement of the cost position. It is therefore important that effective measures be taken to prevent new speculation attacks and "currency dumping" in the run-up to monetary union. One possibility would be the fixing of the conversion rates on the basis of a medium-term retrospective average.

3. Impetus for the internal market

The single market will not fully exploit its potential as long as various currencies exist side by side and tie up valuable resources - not to mention the structural distortions of unpredictable exchange rate movements. Without a monetary union, the internal market would remain a skeleton.

... Performance competition and competition of tax systems

In a monetary union, the prices in the markets of goods and services can be easily compared with each other across the borders. This is an advantage for companies, since trade within the internal market will be strengthened.

Certainly nothing will be given to the German industry in this Euro-bloc. Many experts expect a more intense competition. But in this competition enterprise achievement will be the decisive factor - and not the foreign-exchange markets.

Under the umbrella of the monetary union the national tax systems are also coming under competitive pressure. Monetary union requires a close interlocking of financial policies for its functioning, which will have an impact on the design of national tax systems.

The increasing regional competition will force an adaptation of the control systems in longer-term perspective and provide for lower tax rates. Then in the tax area recumbent competitive distortions belong to the past.

... Euro strengthens financial center of Europe

The euro will become next to the Dollar and the Yen a dominating global currency. Its market share will be greater than the sum of the single currencies that merged into it.

On this basis a big liquid euro-finance market will develop, which will offer enterprises more attractive financing and investment possibilities than today's split national currency markets. The competition between financial centers in the financial markets, but also in the banking and insurance industries, will grow. Enterprises will benefit.

Monetary union is a magnet for capital inflows from third countries, thus allowing lower interest rates, because foreign investors need to worry less than before that a part of their income is eaten up by exchange rate losses. This increases the accumulation of capital and enhances the attractiveness of the financial center of Europe.

About the – yet to be established – European SME stock exchange EASDAQ, the common currency with greater transparency could facilitate access to capital for small and medium enterprises.

Apart from the immediate financing aspects, the monetary union will create new incentives for long-term growth and employment in the financial services sector. This will also radiate indirectly to the industrial sector.

... Monetary union protects against "Fortress Europe"

Monetary union does not contradict the strengthening of our transatlantic relations, which are especially vital for the German industry. Europe needs today more than ever the American model of dynamism. Especially for Germany, the long-term protection of geographical expansion and growth by the expanding American market has priority. America and Germany, NAFTA and the EU could only benefit from closer economic cooperation. It would not at all be in the interests of German industry, if the markets of the European Monetary Union would cut themselves off after the introduction of the euro against unwanted outside competition. A "fortress Europe" which deals only with itself must be absolutely avoided.

4. Dynamic Europe through stability

Only if the euro is stable enough, is it to translate to appropriate efficiency gains and cost benefits for the enterprise. Monetary stability is traditionally a first-grade location factor for German companies. By securing income, pensions and financial assets from depletion, stability has an important social function. It has helped preserve social consensus in our society.

... Monetary Union as a Stability Community

Moreover, as can be proven, price stability also leads to permanently lower interest rates, tends to moderate wage settlements and to avoid the taxation of fictitious profits. This improves the conditions for higher growth and employment dynamics.

Throughout Europe high stability standards have immediate positive consequences on our economy. A healthy growth of our partners also promotes the economic development in Germany. This state is established by the euro.

To permanently protect stability, important basic conditions were enshrined in the Maastricht Treaty. This includes the fulfillment of strict convergence criteria, an independent European Central Bank's monetary policy objectives and structures along the lines of the German Bundesbank, and precautions against unsound fiscal policies that could undermine a stability-oriented monetary policy.

... Enormous progress towards stability in Europe

The fear that the monetary union could be an inflationary Community is not realistic. Already, the pressures for convergence have brought a considerable gain in stability. The average inflation rate in Europe fell by ca. 14% in 1980 to well below 3%. The price increase rate of the core countries is around 2%.

The success of fighting inflation in the EU is pretty much based on the realization that inflation does not permanently solve growth and employment problems.

Neither the wage, nor the financial policies of individual countries are likely to have a lasting influence on the common monetary policy, thereby undermining stability. This can be already anticipated by the economic weight of the participating States in relation to Germany.

Naturally, there is no absolute guarantee for the stability of the single currency. But that's the case for the D-Mark.

Provided that the monetary union consists of countries with roughly the same "stability culture", it is not to be expected that the currency depreciation will be substantially higher than nowadays in Germany.

... Interest-rate fears unfounded

With the elimination of exchange-rate risks, there is a tendency of alignment of interest rates among the participating States. But today the interest rates of potential EMU participants are close together. Consequently, the German view is that no interest-rate jump is to be expected.

The interest-rate convergence will continue as the final Monetary Union approaches. With proper selection of participants and application of the convergence criteria, the currency changeover implies no risks beyond normal market fluctuations.

How interest rates develop after the start of the monetary union, depends very substantially on the confidence of international financial markets in the new single currency. If it is possible to preserve and enhance stability, this could have a positive impact on Community interest rates. In any case, fiscal consolidation pressure will lead to an easing in interest rates.

5. Beneficial constraints on economic, fiscal and wage policy

Monetary union is certainly not a "panacea". To improve European and German long-term competitiveness, it takes more than the euro. But the monetary union will help ensure that the tasks that lie ahead are finally being addressed.

Monetary union has already produced tremendous disciplinary coercion. Even in Germany the debate about the "lean state" has gained in intensity in the light of the upcoming monetary union. The sometimes uncomfortable, but very wholesome, competitive pressure on policies will continue to increase. This provides reasonable opportunity to overcome the onerous structure of our business location.

... Wages in the competition

With the elimination of exchange rate differences, national economic policy framework and location deficits are more apparent. Therefore, between enterprises of the participant member states, costs, productiveness and product quality will primarily determine their competitiveness. The cost impact of wage settlements becomes sustainable within the currency area.

The function of exchange rates as a compensation instrument will now be handled by other mechanisms. Excessive wage settlements hit full employment. Wage flexibility is not far, neither this country nor in our European partner countries. It has to happen a lot!

The euro creates wage transparency, and labor markets come into closer competition. This should make it difficult to separate wage development from the development of productivity in the future in all Member States, including Germany.

Greater flexibility of labor markets and wages is fundamental to solving the employment problem in the European Union - whether with or without monetary union. If a certain compulsion in this direction comes from the monetary union, this is to be only positively evaluated .

... No automatic redistribution

The frequently expressed concern that with the monetary union a giant redistribution machine would be a set in motion is quite excessive. Inevitably, new compensatory payments have been so common because fiscal policy will remain in national hands even after entry into the monetary union. Effective budgetary decisions of the EU require a unanimous vote of the Member States.

If the monetary union represents a relatively homogeneous economic bloc, the need for new financial transfers is low anyway. Meanwhile, the economic reality shows an astonishing harmony not only in the economic processes, but increasingly in the economic structures and mentalities, as well.

The disparity of wealth in Europe is sometimes overestimated. The per capita economic output of Italy, Spain and Ireland is no less than that of West German states. The existing performance gap in the EU is by no means too large for a stress-free integration of the majority of Member States into a common currency area. The failure of the euro project appears more hazardous: The convergence pressure would subside, the European economies would diverge again. That would mean additional transfer needs.

... The Stability Pact promotes fiscal discipline

Disciplining effects of financial policies also stem from the monetary union. Already the Maastricht Treaty provides for a regulatory mechanism that restricts the scope for debt of the member countries. These include the prohibition of monetary financing and privileged position of states in capital markets, as well as the exclusion of a joint liability of the Community and the Member States.

Compliance with the fiscal convergence criteria is important and necessary, even after the onset of the monetary union. It may happen that a common monetary policy will not occur because of unreliable financial policies of one or several member countries. But one should not paint it black: In recent years most EU countries have gained the experience that structural problems cannot be solved by a debt policy. The political will to improve public finances is more widespread than sometimes thought.

Nonetheless, the proposed provisions are not stringent enough to effectively and permanently prevent fiscal misconduct even after entry into monetary union. Also the contractually provided sanctions still lack "bite". The "Stability Pact for Europe" presented by Finance Minister Waigel, which in particular provides for automatic sanctions, would reduce the risk of unsound fiscal policies. All in all, the idea of a binding Stability Pact was received positively by our partners, even though it is not yet in "the bag".

Cornerstones of stability pact

• The 3% limit for new debt is to be maintained even in economically unfavorable periods, and in economic "normal" situations a medium-term cap of 1% of GDP should not be exceeded.

• If a participating country crosses the of 3% deficit limit, automatic sanctions are enforced. The country concerned has to pay a non-interest bearing "stability deposit" in the amount of 0.25% of GDP per every percentage point of deficit overrun, which is refundable upon successful consolidation.

• If after two years, it continues to miss the stability limit, the of deposit is transformed into a fine. A "European Stability Council" watches over the rules of the game.

A binding agreement would be an additional test of how serious those countries are to pursue sound fiscal policies that support the stability mandate of the European Central Bank. It would be an important signal to financial markets and help in the acceptance of monetary union.

... Maastricht as part of the solution

In the run-up to monetary union, all Member countries promote stability and sound public finances. It is not to be ruled out that the convergence pressure exacerbates the short-term economic tensions in some countries. The consolidation of public finances will temporarily cause "withdrawal effects" of the public and private demand, which nevertheless will soon be more than compensated due to falling interest rates, lower inflation expectations and greater scope for investment. A sustained recession, is not likely to come out of this.

Studies of the International Monetary Fund show: Over the past 30 years, consolidation has always paid off in the form of profit growth and new employment opportunities. The overall economic impact of the consolidation process also depends largely on whether the reduction of budget comes about by a rise of the income or by a lowering of the expenditures. A return to the national debt is economically necessary in every case - regardless of whether a monetary union is present or not.

In a nutshell: Maastricht is not a problem for our economy, but part of the solution!

IV Currency conversion: What les ahead for businesses?

The way to the Euro

Spring 1998

• Decision on the start date and the participants of the monetary union

• Establishment of the European Central Bank (ECB)

• Start of production of banknotes and coins of the single currency

• Adoption of the changeover laws and other acts

• preparation of the changeover, especially in the financial and banking sector

From 1.1.999

• Irrevocable fixing of conversion rates between national currencies and the euro

• The ECB accepts responsibility for the common monetary policy

• Conversion of large-value payment system (TARGET) to euro

• Isolated introduction and use of the euro in the corporate sector

• Settlement of the interbank market, capital and foreign exchange euro markets

• Conversion of public debt

From 1.1.2002

• introduction of euro banknotes and coins

• Conversion of the public, businesses and households

• 01/07/2002: Euro becomes the sole legal tender

1. When and how the conversion?

In addition to a solid foundation of stability and a broad acceptance of the new single currency for the economy and the population, the practical regulation of the organizational and technical side of the project is of considerable importance for the success of monetary union. The Heads of State and Government endorsed the changeover scenario at the EU summit in Madrid at the end of 1995.

2. The market punishes latecomers

It is not long until the entry into the monetary union. For all companies the road to monetary union is connected with some complex change processes. The conversion of the D-mark to the euro has multiple effects on enterprises.

The introduction of monetary union has particular implications for the areas of IT, business organization, accounting, contract and pricing, financial and investment planning, payments. It is important that preparation for the changeover starts early. This will help stretch the action over time to avoid bottlenecks and minimize the burden on businesses as much as possible. Latecomers will find it harder. The risk of non-preparation is much higher than the workload for a not-postponed changeover!

According to surveys, around 90% of German companies have not yet fully dealt with the effects of monetary union concerning them, let alone made concrete preparations. Two-thirds admit a lack of information. However, the proportion of companies that adjust to monetary union is growing.

It is essential that enterprises - if they have not already done so - soon form cross-divisional project groups and appoint a "Euro-officer" who will coordinate all internal conversion and adaptation measures.

The currency conversion is more than a purely computational procedure. Nevertheless, all companies - large, medium or small - basically face the same challenges. At the beginning of each preparation the systematic analysis of the potential impact falls on each company.

To be considered:

• What are the consequences of monetary union for the various cross-sectional features of the company?

• What is the strategy for the in-house conversion, that arises?

• How can this strategy be translated into a coherent concept and included in a timetable?

The choice of the conversion time is a key decision point for the company. It should be different depending on company size, industry, different degrees of international involvement, etc. Choosing the right moment helps save costs.

It should be noted that the content requirements in the individual business areas may require different dates for the start of the work. It can not be ruled out that the company will become involved in a "changeover" as a result of the pressure exerted by suppliers, customers or competitors.

Several large companies have already indicated the willingness for transition to the euro shortly after the start of the monetary union. They are preparing with determination for the D-day. It is advisable to make the switch of accounting and reporting at the beginning of the new fiscal year. It is also advisable to synchronize the date of change with the changes in information technology that are already planned at the turn of the millennium.

Despite the remaining uncertainties regarding the start date and the participants of the monetary union, the conversion work should begin as early as 1996, at least with the internal analysis.

Small- and medium-sized enterprises are not alone in the preparation for the changeover. Banks, management consultants, accountants, chambers and trade associations will assist them with this certainly difficult task.

3. Euro checklist for key business sectors

The following checklist points to problem areas that must in each case be followed by the companies to prepare for the changeover. These notes are the first suggestions and by no means complete. Often the law and regulators and the European Union have not yet created the necessary conditions.

So EU Council Regulation to be considered for the changeover shall be finalized by end of 1996. For example, to clarify the legal status of the euro during the transitional phase and the question of how the rounding problem is solved.

Various laws and regulations at national level must be adjusted in light of the upcoming conversion process.

In your interest: more practical aspects are planned to be discussed with further specification of the particular legal framework for the introduction of the euro, in more detail in a "BDI Euro Special".

Payments

The use of the euro as book money is at first voluntary in 1999, for the non-banking sector. The principle: no impediment, but no obligation. Companies may decide at their own discretion when to change.

This means that, in the transitional phase, companies do not necessarily have to settle payments through their own euro account. Payments can be made or received in Deutschmarks or euros. The conversion and settlement will be done by the banks. They will adapt their product range to meet the needs of their corporate clients and offer services as Converters for payment transactions.

While all of this requires extensive conversion activities within the banking sector, the payment rearrangement poses relatively few problems to businesses. From the business perspective the payments are rather an area whose rearrangement can release substantial rationalization in the long term and may open up cost reductions. There are currently around 60 payment systems in use in Europe, needlessly consuming money. In addition to efficiency gains, a simplification and acceleration of payment transactions can be expected.

What to do?

• identification and definition of the technical measures for the conversion of payments

• facilitation of cross-border payments between the euro and the non-participating countries in the Monetary Union

• consideration of a possible reorganization and concentration of bank accounts

• Conversion of payment transactions with the central banks, financial institutions and commercial banks in the light of the purpose intended or desired dates

Financial Management

The approaching monetary union will strongly influence the interest-rate and currency landscape during the coming years. In the future, it will have to be taken into account in every responsible interest and currency management, in some cases before it enters monetary union.

The demand and credit risks in the monetarily united Europe are ultimately subject to the same mechanisms as before in the national context. With the introduction of the euro, the currency exposure will be reduced by the export proceeds generated in the EMU countries, and thus also the corresponding hedging transactions.

The reduction of the currency exposure entails fewer risks, but at the same time fewer opportunities to participate in favorable exchange-rate movements. The financial markets are differentiated on the other hand, opening up new opportunities for business financing.

What to do?

• Review and if necessary adapt financial economic principles in terms of borrowing and the protection of remaining interest rate and currency risks

• treatment and fulfillment of open interest and foreign exchange forward contracts after 1999

• Analysis and any new appraisal of the exchange rate development of third currencies and of the currencies not taking part in the monetary union

• reviewing the options of raising capital and the investment management

• Valuation of interest rate risk ahead of the transition to monetary union in terms of the maturity of capital raising and equipment

• rethinking of organizational and personnel changes in the risk management

Accounting / Bookkeeping

Companies are likely to have three years to adapt their accounting systems. You can instantly switch to the euro, maintain parallel accounting in Deutschmarks and euros, or make the changeover to the euro from 2002 onwards. Double accounting is not required.

The monetary union, unlike a currency reform, leaves the balance-sheet items unaffected. Since the currencies of participating countries are not revalued or devalued during transition, no revaluation of balance sheet items occurs. All that is required is a conversion of existing DM values in € according to the fixed exchange rate on 1/1/1999.

What to do?

• Determine the timing of migration

• Conversion of internal and external accounting to euro

• Check for any conversion problems in the transition

• consideration given to the transition date different fiscal years

• Any rounding adjustment to equity through a capital increase or reduction of capital

IT

The changeover to the euro requires appropriate IT technical adjustments. These adjustments particularly affect the areas of balance sheet / accounting, cost accounting and reporting, treasury, investment planning and human resources.

Computer technology and communication systems are increasingly versatile. Thus, the currency conversion is greatly simplified.

What to do?

• Identification the company's cross-divisional functions affected of the IT changeover to the euro

• Review of currently used software for suitability and decide on IT-related adjustments

• Contact with software and hardware vendors for timing and content of planned measures

Controlling and reporting

The currency conversion in principle affect all existing and stock and flow values. Assignments, projects, and internal transfer prices must be converted to euros by D-Mark.

What to do?

• Conversion of all the economic fundamentals and economic indicators with DM components

• Ensure the continuity of the update of statistical time series and period comparisons

• harmonization of the planning cycle with the basic dates for the Monetary Union

Contracts

The longer term - beyond 2002 - contracts will continue to be in force. The changeover does not mean elimination of the basis and does not provide sufficient grounds for unilateral termination of the contract.

Contracts with third-country contact, which were concluded on a DM basis, are continued with the fixed exchange rate in €, if the third country reference allows it and no other contract provisions apply.

What to do?

• Conversion of long-term contracts

• Decision on the treatment of contracts with third countries

• Decision on necessary transitional clauses for currently signed contracts

• Adaptation of the commercial and payment terms.

Procurement and Sales

With the introduction of the euro, a larger currency space is established. As a result, prices are directly comparable, which will increase price transparency and price competition.

What to do?

• Strategic purchasing considerations, especially in terms of priorities for procurement in EMU and non-EMU countries

• Change in prices and possibly dual pricing in the transition period

• Treatment of prices with threshold and signal character

• Analysis of customer and competitor structure

• Review and if necessary realignment of sales territories

Human Resources

Even the personnel department is not left out of the expected changes. However, most measures concern a later date.

What to do?

• Define the date for conversion and payment of wages, salaries and pensions in euro

• Adaptation of existing contracts with employees

• Consider the impact on the in-house and external social systems, in particular Pension obligations

• Timely in-house notification of employees about the transition arrangements and the consequences for the company

• Timely training of staff

The monetary union will require changes not only in the cross-divisional functions of companies. Individual industries are also directly affected into their core business, particularly among the automatic teller machines industry, software and hardware manufacturers, and paper and printing industries.

In the wake of the changeover you can expect a short-term boost in orders and should be timely adjusted by appropriate profiling of the product changes. On the client side, possible bottlenecks should be considered when awarding contracts. Here, as there it goes: the market will punish latecomers!

4. Cost of currency conversion: Investing in the Future

The downside is that the currency conversion, like any investment, is of course costly.

Cost of currency conversion

• Change in the IT field

• Organizational restructuring

• Machines adaptation

• New price lists and catalogs

• New forms

• Consulting Services

• Specific financial services related with the conversion

• Customer Information

• Internal and external staff training.

These are essentially one-time costs, spread over a period of one to three years. There are now only rough estimates about the order of magnitude of the cost to individual companies. Consequently, for large industrial companies costs in the tens of millions are expected. Of course, the bill for small and medium-sized enterprises is different.

However, it is difficult to unambiguously assign the costs incurred by the currency conversion. Moreover, the cost by itself does not say much, if the cost savings are not also included in the calculations. The latter are not necessarily immediately visible in dollars and cents, but rather extend over a longer period.

The company can assume that the cost of the transition can be offset, at least partially, by the overdue rationalization and organizational development. Regular financial statements and the creation of new price lists will only be changed in euro terms. The financial costs will be kept within acceptable limits through active management and cost synergies.

V. Conclusion: The euro has come

1. Opportunities outweigh risks

After a critical assessment of the opportunities and risks inherent in a single European currency, the "EMU Industry Forum" comes to the conclusion that the benefits are clearly predominant for the German industry.

So far, not all risks are eliminated. For the dangers to be removed in time, they should be strongly pointed to in the future. This concerns in particular the conclusion of a binding agreement for the additional long-term securing of sound public finances and the installation of a stable and viable exchange rate regime between the "ins" and "outs".

On the other hand, skepticism should not prevail, because tangible advantages are important for German industry:

• The euro increases planning security for the industry, because exchange rate risks are eliminated within the monetary union.

• In this way, the euro will create equal opportunities between companies open to the foreign exchange markets and those who can not afford expensive protection against currency fluctuations.

• The euro will help ensure that in the European single market, a more intensive, but also fairer competition asserts itself, in which service, and not monetary projections, is the decisive factor.

• The euro will lead to greater stability in Europe, because the monetary union exerts a constant pressure on the fiscal policies of the participants and those countries wishing to join.

• The euro will exert a pull on the other currencies in Europe, so that it can take over the function of a stable anchor currency far better than the D-Mark.

• As a core element of the European unification process the euro helps prevent that Europe falls behind in a time of nation-state egoism.

• Finally, the euro is improving the conditions for the EU to open up to the candidate countries in Central and Eastern Europe. This will benefit German industry in particular.

2. Failure of the monetary union would set Europe back

The more favorable the balance of opportunities and risks will turn out, the more successfully the "magic eurotriangle" – stability criteria, timing and participants – is harmonized.

The risks associated with a shift of the schedule should not be underestimated. Not only would the convergence efforts decrease, but also credibility would be at stake. Waiting does not improve chances!

It seems more sensible to begin in time on 1/1/1999 with a smaller group of participants. The basis for selection of the participating States are the contractual convergence criteria.

For the fiscal criteria, the Maastricht Treaty makes room for political discretion, which should be used responsibly in the spirit of the Treaty. The will and the ability of a country to belong to a long-term stability community must be decisive.

If the monetary union does not materialize in the foreseeable future, this would have serious consequences: The achieved level of integration would be damaged. In particular, new exchange-rate turbulence would be expected. The appreciation trend of the D-Mark could continue. Under these circumstances how should companies be able to sensibly plan their international investment and commercial strategies?

Besides, if the monetary union fails it must also be feared that the convergence efforts in the EU states will wane. The incentive of sooner or later joining the monetary union is an essential motive to provide stability and regular public finances.

If the monetary, fiscal and wage policy casualness returns in Europe, the urgently needed strengthening of European competitiveness would be pushed to the back burner. Above all, the competitiveness of German industry would be exposed to new strains.

Finally, we must not loose sight of the negative impact of a failure of monetary union on integration in other fields. Then it is questionable whether significant progress can be expected even in the harmonization of foreign, fiscal, environmental or transport policy.

3. Clear signals necessary now

The starting point for the launch of the monetary union and the introduction of a common European currency has been set. It is now important to consistently work towards the target date of 1/1/1999, to which the Member States have committed themselves by treaty. It will not be long till then. Now we need clear signals from the political sphere. Companies need clarity as soon as possible!

The current excess in the fiscal convergence criteria, in Germany as well, is no reason for resignation. Indeed, this precarious situation requires to immediately reverse this process. Every effort must be made to pursue the consolidation of the public finances, urgently needed even without the monetary union.

Germany and its European partners need a forward-looking economic orientation. The monetary union will play a key role. The timely entry into the monetary union should not fail because of Germany.

Chairman:

Hans-Olaf Henkel, BDI

Deputy Chairman:

Dr. Marcus Bierich, Robert Bosch GmbH

Dr. Gerhard Cromme,

Friedr. Krupp AG Hoesch-Krupp

Dr. Jürgen Heraeus, Heraeus Holding GmbH

Jan Kleinewefers, Kleinewefers-Beteiligungs GmbH

Prof. Dr. Hans-Joachim Langmann, Merck KGaA

Prof. Dr. Berthold Leibinger, Trumpf GmbH & Co.

Dr. Tyll Necker, HAKD-Werke GmbH & Co.

Dr. Arend Oetker, Dr. Arend Oetker Holding GmbH & Co.

Dr. Christian Roth, Bilfinger & Berger AG

Ernst G. Stöckl, AEG AG

Helmut Werner, Mercedes-Benz AG

Advisory Board:

Chairman:

Dr. Marcus Bierich, Robert Bosch GmbH

Deputy Chairman:

Dr. Ludolf v. Wartenberg, BDI

Dr. Wolfgang Brühl, Hoechst AG

Prof. Dr. Gerhard Fels, Institut der deutschen Wirtschaft

Christian Hiller von Gaertringen, Die Welt

Dr. Klaus-Wilhelm Knauth, Gesamtverband der deutschen Versicherungswirtschaft

Dr. Hans-Joachim Massenberg, Bundesverband deutscher Banken

Dr. Peter-Rüdiger Puf, Daimler-Benz AG

Dr. Hans-Jürgen Schulte, Hille & Müller KG

Dr. Bernd Stecher, Siemens AG

Dr. Karl-Heinz Wessei, Bundesverband deutscher Banken

Coordination:

Dr. Reinhard Kudiß, BDI

Add new comment